SRM can be used to track the deprecation of a non-rental asset such as company owned buildings, hardware, or vehicles.

To track the deprecation of a company asset that is not part of the rental fleet it is still created as a rental product number, but can be configured to be a "Non-Inventory" asset, preventing it from displaying as part of the rental inventory for general use.

Prior to creating these assets however foundational setup should be reviewed/created.

Deprecation Methods/Classes

Accessed under: System Maintenance Menu -> Configure System Settings -> Accounting Tab -> Inventory -> Depreciation Methods | Deprecation Classes

Many firms will want to use a different method and class of deprecation for their non-inventory assets. There are 6 valid methods allowed.- # - Percent of Revenue - No Post

- % - Percent of Revenue

- A - Flat Rate

- D - Declining Balance

- M - MACRS

- S - Straight Line

For more information on the setup and configuration of Deprecation Methods please review the full Help File Documentation on that screen.

The Depreciation Class is used to determine the rate of depreciation and the residual percentage. Similar to Methods, please review the Help File Documentation for that section for detailed instructions on the types and setup of the Class.

Asset Classification and Organization

It is strongly recommended that a separate Rental Class and Group be setup for these assets.

Rental Class

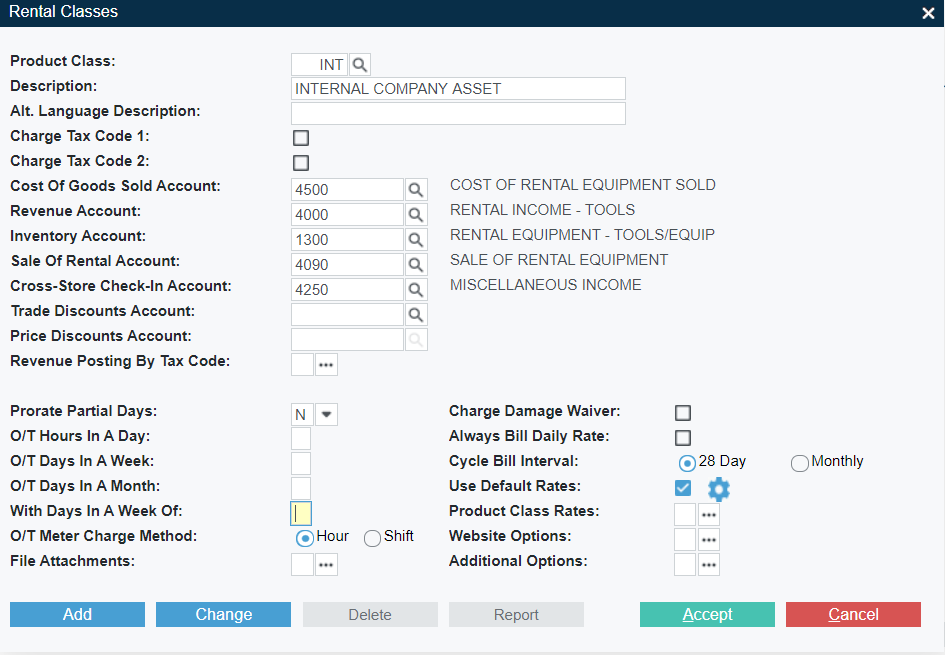

Most firms would setup a single Rental Class for assets of this type. Rental Classes are accessed under: System Maintenance Menu -> Configure System Settings -> Accounting Tab -> Inventory -> Rental Classes

Click Add to being adding a new Rental Class. The following is an example:

General Ledger Account information defaults from the Rental Class Defaults configuration, but can be overwritten with separate GL Accounts if required.

Rental Group

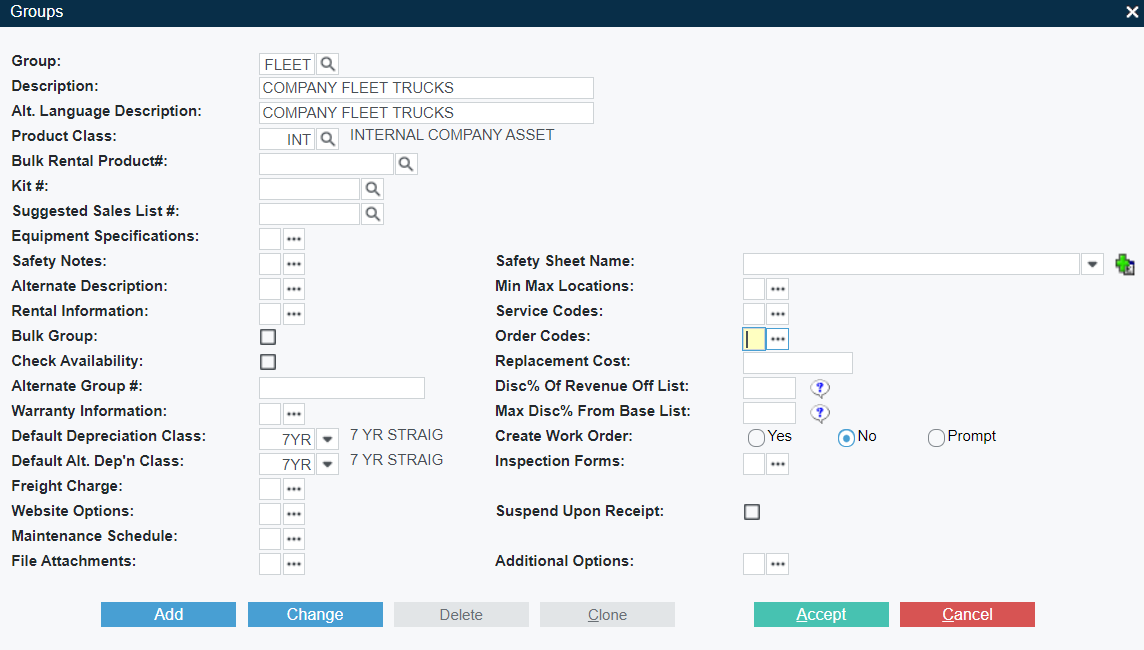

Depending on the number/variety of assets that need to be tracked, one or more Groups can be created to collect these assets together. Groups are accessed under: System Maintenance Menu -> Configure System Settings -> Operations Tab -> Inventory -> Groups

Click Add to begin adding a new Group. The following is an example:

A Default Deprecation method can be defined on the Group, that will become the default Deprecation Method assigned when a new asset is created in this Group. Other options may be useful to be filled out based on business needs.

Non-Inventory Asset Creation

To create the asset, there are two methods:

1: Playing catchup - adding assets that are already owned

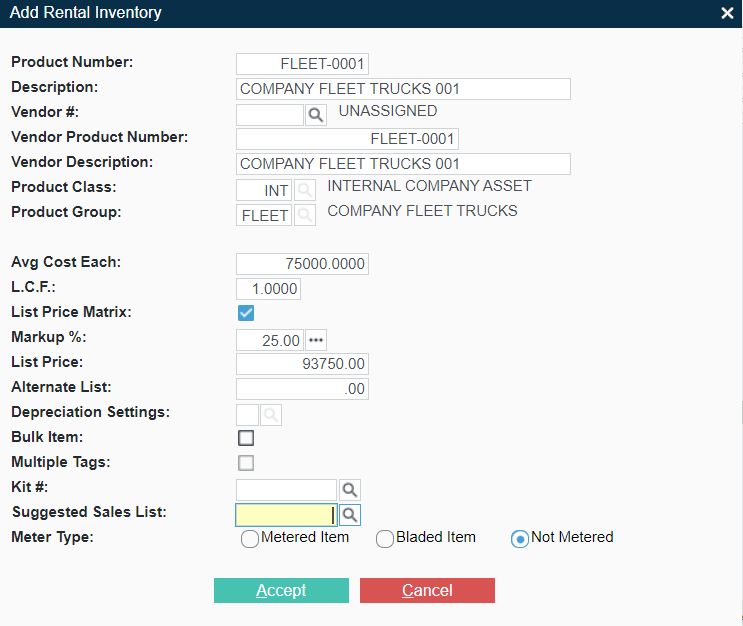

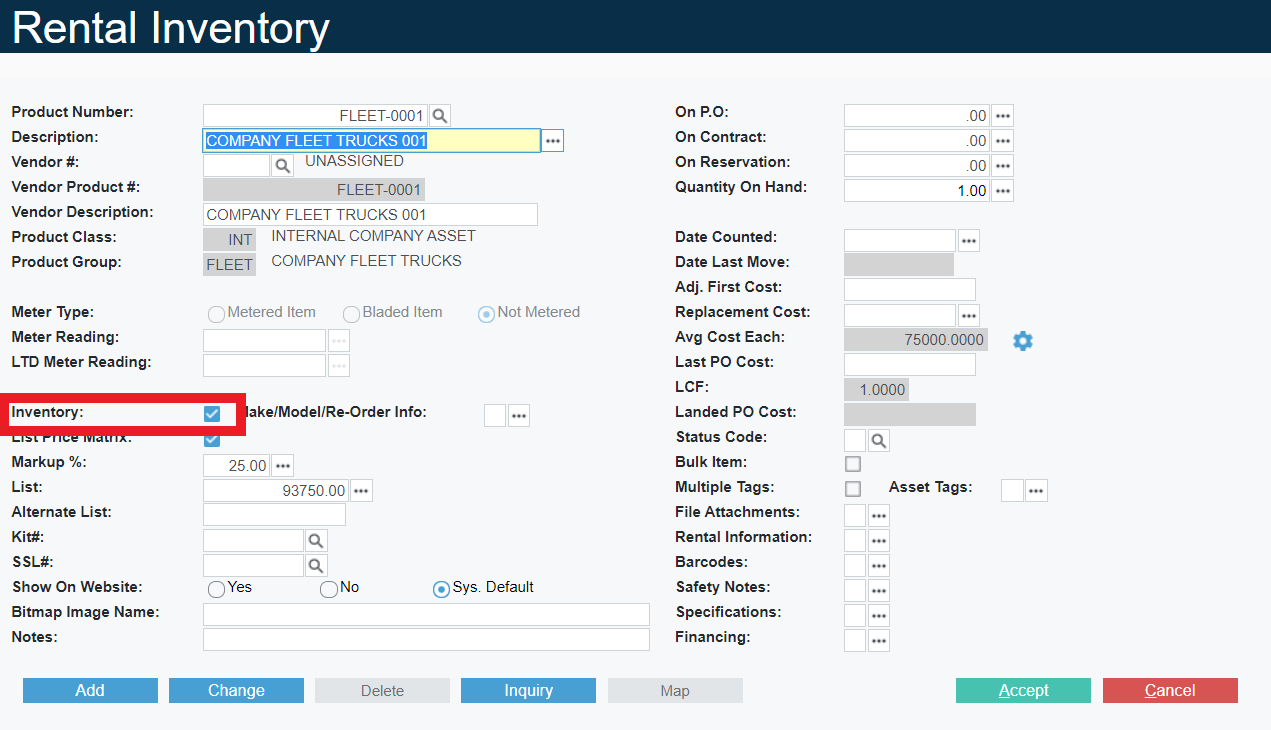

Access Inventory Control Menu -> Rental Inventory and click Add to begin adding a new Asset. Fill out the asset information as completely as possible, using the Rental Class and Group(s) that were setup for this purpose:

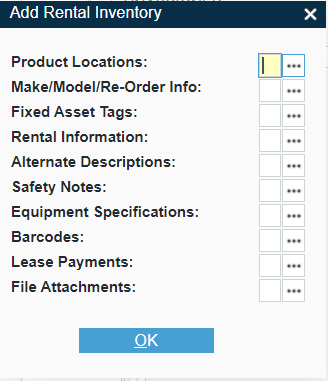

A secondary window will appear where the assets current location quantity and Asset Tag information at a minimum should be entered:

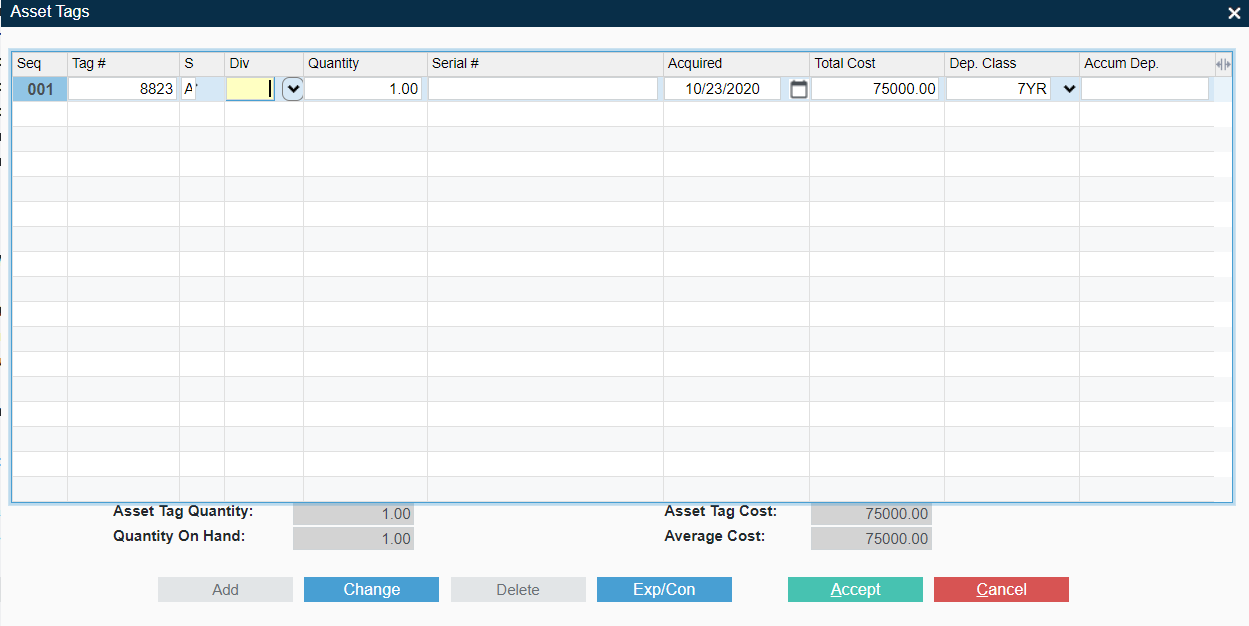

The Asset Tag information will default from the previous settings, but can be overridden if required:

After Accepting these details the asset is created, but must be set to Non-Inventory. Under Inventory Control Menu -> Rental Inventory enter the Asset Number to review it's details. Remove the Checkbox from Inventory:

Run Deprecation

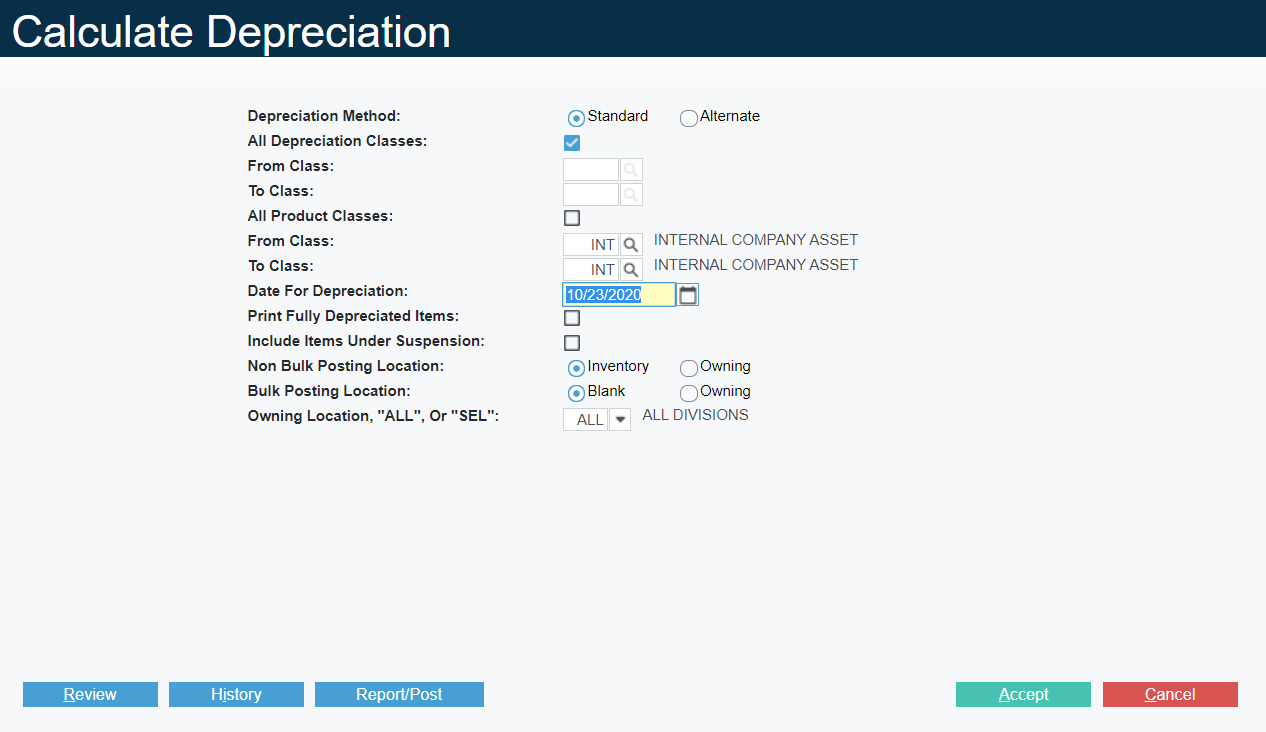

Deprecation Calculations are run under Inventory Control Menu -> Calculate Depreciation

Deprecation can be run for the specific Class of internal assets, or all classes. For detailed information on the full deprecation process, it is recommend the Help File Documentation for those screens be reviewed.