How to troubleshoot balance sheet discrepancies in Texada SRM.

Quick Reference

- If you have encountered discrepancies when running balance sheets in Texada SRM, there are a number of techniques you can employ to troubleshoot and resolve them. These are rebuilding your statement layouts and resummarizing the General Ledger; checking your most recent year-end posting against your latest income statement; and checking for and removing back-dated entries.

- To Rebuild and Resummarize:

- Open Texada SRM and navigate to System Maintenance → Configure System Settings → Accounting → Statement Layouts.

- Click “Build”, then select “Generate Statement Layouts” and click “Accept”.

- Click “Accept” again, then “Yes”.

- Exit the Statement Layouts utility and navigate to General Ledger → Financial Statements → Summarize for Financial Statements.

- Enter the period for which you are troubleshooting into the “Period Start Date” and “Period End Date” fields, then click “Accept”.

- Rerun the balance sheet and see if the discrepancies are resolved.

- To Check the Most Recent Year-End Posting:

- Open Texada SRM and navigate to General Ledger → Financial Statements → Income Statement.

- Select your preferred reporting type and click “Accept”.

- Open the report and note the “Net Profit (Loss)” amount for the current period.

- Exit the Income Statement utility and navigate to General Ledger → Account Inquiry.

- Run the Account Inquiry utility on the PLRE account, with a Year / Period Start Date of 01/01/1901 and a Period End Date of 12/31/2999.

- Open the report and verify that the most recent Year End Close debit amount matches the Net Profit (Loss) amount from your income statement. If not, you will need to correct this entry to make these values match.

- To Check for Back-Dated Entries:

- Open Texada SRM and navigate to General Ledger → Account Inquiry.

- Run the Account Inquiry utility on the PLRE account, with a Year / Period Start Date of 01/01/1901 and a Period End Date of 12/31/2999. Open the report and note the Transaction # and Date of the most recent transaction.

- Exit the G/L Account Inquiry utility and navigate to General Ledger → Account Inquiry By Transaction #.

- Run the Account Inquiry By Transaction # utility using the Transaction # and To Posting Date from your most recent PLRE transaction.

- Open the report and look for any transactions posted after the most recent PLRE transaction. Any such transaction will need to be reversed.

Introduction

When running the Balance Sheet utility in Texada SRM, you may discover that there are discrepancies in your financial records - meaning, your total assets do not match your total liabilities. These discrepancies can be caused by a number of factors, many of which can be resolved with some simple troubleshooting within SRM.

This article will explore the following techniques for resolving balance sheet discrepancies:

- Rebuild and Resummarize: Rebuild your statement layouts and resummarize the General Ledger to remove errors.

- Check the Most Recent Year-End Posting: Ensure that the net profits / losses from your latest income statement match your most recent Year End Close debit amount.

- Check for Back-Dated Entries: Ensure that no transactions have been posted after your most recent Year End Close transaction.

See the sections below for detailed instructions on each of these techniques. If you are still unable to resolve the discrepancies after trying these techniques, contact Texada support for assistance.

Rebuild and Resummarize

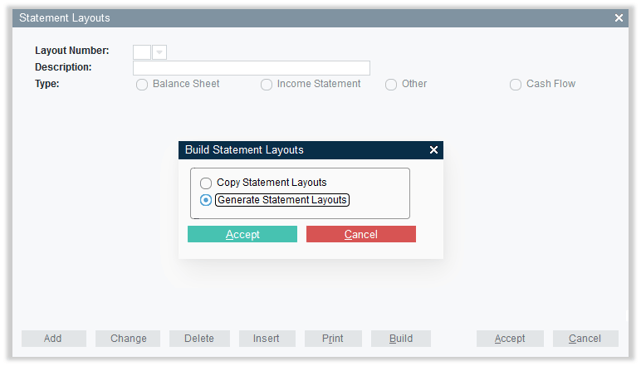

- Open Texada SRM and navigate to System Maintenance → Configure System Settings → Accounting → Statement Layouts.

- Click “Build”, then select “Generate Statement Layouts” and click “Accept”.

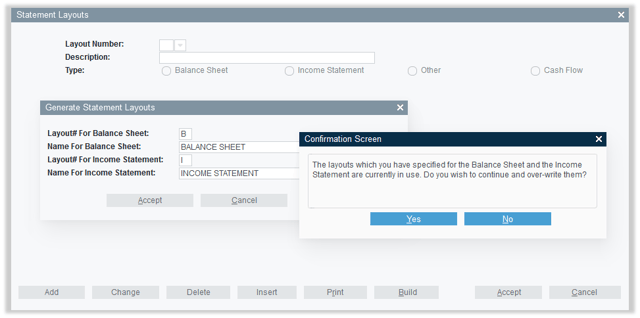

- Click “Accept” on the Generate Statement Layouts window. A message will appear that reads “The layouts which you have specified for the Balance Sheet and the Income Statement are currently in use. Do you wish to continue and over-write them?” Select “Yes” to rebuild the balance sheet.

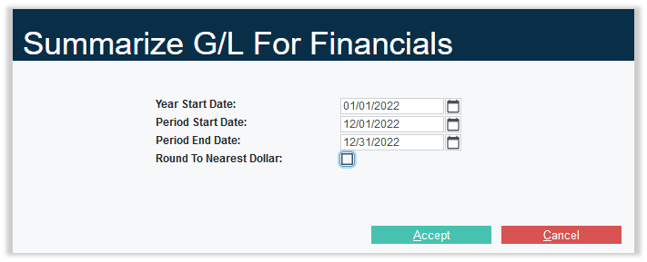

- Now that you have rebuilt the balance sheet, the next step is to resummarize the General Ledger. Exit the Statement Layouts utility and navigate to General Ledger → Financial Statements → Summarize for Financial Statements.

- Enter the period for which you are troubleshooting into the “Period Start Date” and “Period End Date” fields, then click “Accept”. Once the General Ledger has been summarized, you will automatically return to the main menu.

- Rerun the Balance Sheet utility and check if the discrepancy is resolved.

Check the Most Recent Year-End Posting

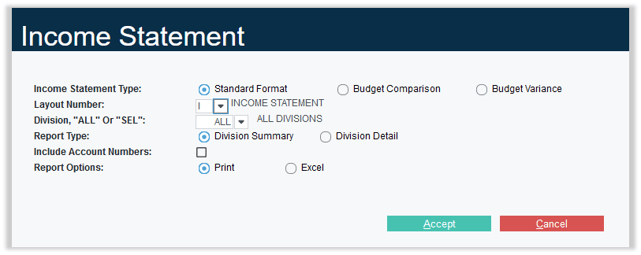

- Open Texada SRM and navigate to General Ledger → Financial Statements → Income Statement.

- Select your preferred output format (Print or Excel), then click “Accept”. This will generate and download an income statement for the current period, either as a .pdf file (if “Print” was selected) or an .xls file (if “Excel” was selected).

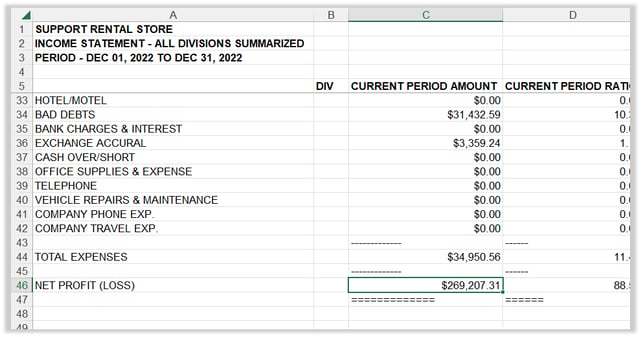

- Open the downloaded income statement file and note the “Net Profit (Loss)” amount for the current period.

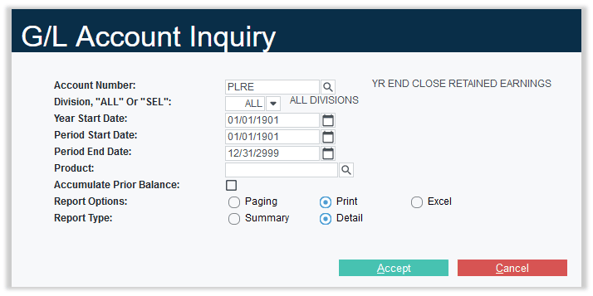

- In SRM, exit the Income Statement utility and navigate to General Ledger → Account Inquiry.

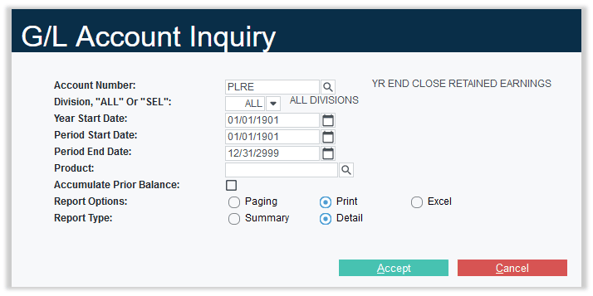

- In the G/L Account Inquiry utility, enter the following information:

- Account Number: PLRE

- Division: ALL

- Year Start Date: 01/01/1901

- Period Start Date: 01/01/1901

- Period End Date: 12/31/2999

- Product: [Leave blank]

- Accumulate Prior Balance: [Unchecked]

- Report Options: [As desired]

- Report Type: Detail

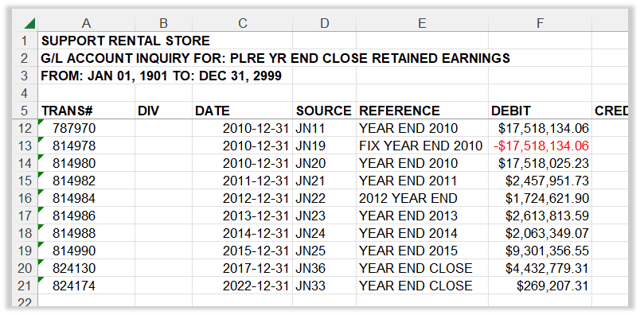

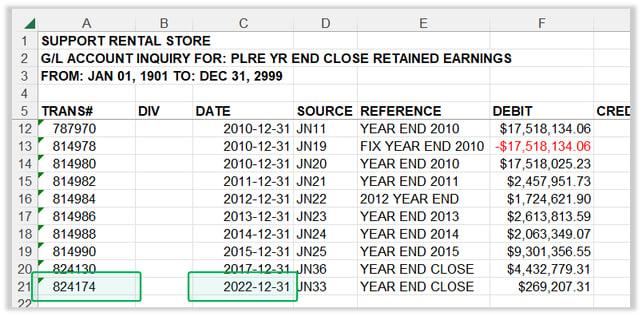

- Click “Accept”. This will generate and download a G/L account inquiry report, either in SRM (if “Paging” was selected), as a .pdf file (if “Print” was selected) or an .xls file (if “Excel” was selected). Open the report and verify that the most recent Year End Close debit amount matches the Net Profit (Loss) amount from step 2 above. If not, you will need to correct this entry to make these values match. When correcting entries, remember that profits are debits to the PLRE account and credits to Retained Earnings, while losses are credits to the PLRE account and debits to Retained Earnings.

Check for Back-Dated Entries

- Open Texada SRM and navigate to General Ledger → Account Inquiry.

- In the G/L Account Inquiry utility, enter the following information:

- Account Number: PLRE

- Division: ALL

- Year Start Date: 01/01/1901

- Period Start Date: 01/01/1901

- Period End Date: 12/31/2999

- Product: [Leave blank]

- Accumulate Prior Balance: [Unchecked]

- Report Options: [As desired]

- Report Type: Detail

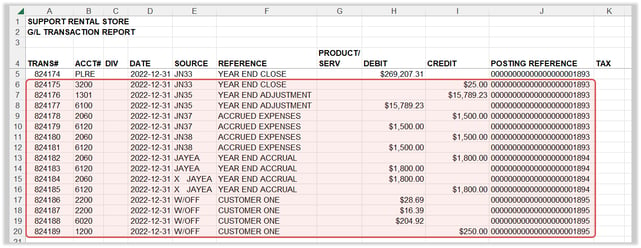

- Click “Accept”. This will generate and download a G/L account inquiry report, either in SRM (if “Paging” was selected), as a .pdf file (if “Print” was selected) or an .xls file (if “Excel” was selected). Open the report and note the Transaction # and Date of the most recent transaction.

- Exit the G/L Account Inquiry utility and navigate to General Ledger → Account Inquiry By Transaction #.

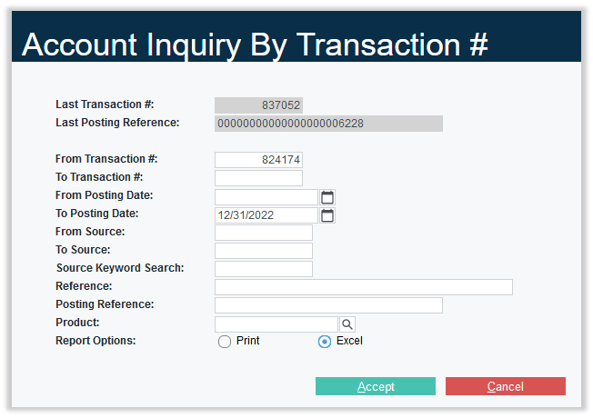

- In the Account Inquiry By Transaction # utility, enter the following information:

- From Transaction #: The Transaction # you noted in step 3 above.

- To Posting Date: The Date you noted in step 3 above.

- Report Options: Excel

- Click “Accept”. This will generate and download a G/L transaction report as an .xls file. Open the report once it is finished downloading. The first transaction in the report, appearing in row 5, should be the year end PLRE transaction from step 3 above. Any transactions posted after this entry will need to be reversed.